Understanding Fire Insurance: Coverage, Costs, and Tips for Homeowners

Fire insurance is a critical part of homeownership, especially for those living in areas prone to wildfires or other fire hazards. While homeowners insurance typically includes some fire coverage, understanding the specifics of your policy and how to tailor it to your needs can help ensure that you're fully protected in the event of a fire. Fire damage can be devastating, both emotionally and financially, so having the right coverage is essential.

This article will provide a comprehensive guide on fire insurance, including what it covers, how much it costs, and practical tips for homeowners to ensure their property is properly protected. Whether you're looking to update your current policy or are new to the process, this guide will help you make informed decisions about fire insurance.

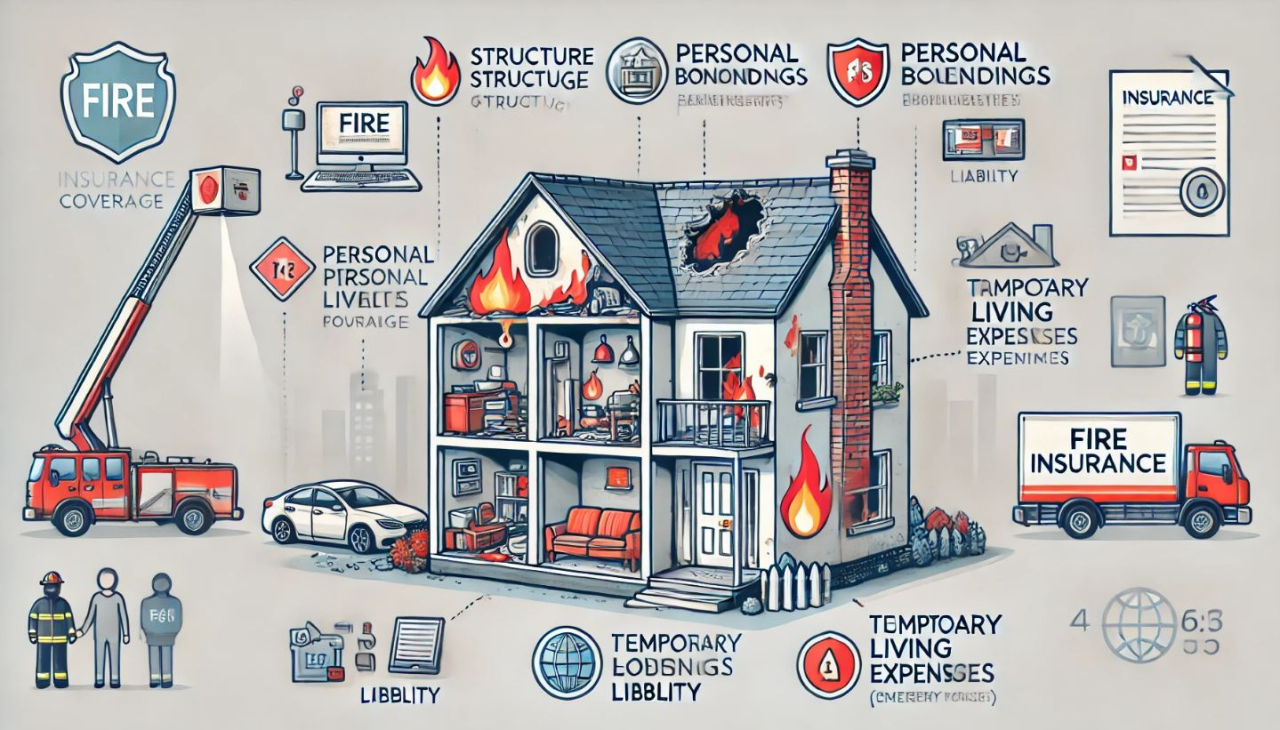

What Does Fire Insurance Cover?

Fire insurance is designed to help homeowners recover financially from the damage caused by a fire. The specifics of coverage can vary depending on your policy, but there are common elements that are typically included:

Structure of the Home

Fire insurance generally covers damage to the structure of your home caused by a fire. This includes the rebuilding or repairing of walls, floors, roofs, and other structural components. It's important to ensure that your coverage limits reflect the cost of rebuilding your home in case of a total loss, considering the current market value and construction costs.

Personal Belongings

In addition to the structure of the home, fire insurance also covers personal belongings that are damaged or destroyed in a fire. This includes furniture, electronics, clothing, and other personal items. Be sure to maintain an updated inventory of your belongings and their estimated value, as this will help you when filing a claim.

Temporary Living Expenses

If a fire renders your home uninhabitable, fire insurance often covers additional living expenses. This can include hotel stays, meals, and other costs related to finding temporary accommodation while your home is being repaired or rebuilt.

Liability Protection

In the event that someone is injured in or around your property due to a fire, your policy may also provide liability coverage. This can help cover medical expenses or legal costs if you're found responsible for the fire.

Understanding the Costs of Fire Insurance

The cost of fire insurance varies based on a number of factors. While the basic premium is generally affordable, the total cost of your fire insurance will depend on the following factors:

Location of Your Home

Homes located in areas that are more prone to wildfires or other fire risks may have higher premiums. Insurance companies assess the risk of fire damage in a particular area, which can significantly impact the cost of your policy. For example, homes in California or Colorado, where wildfires are more common, will likely face higher premiums than homes in areas with lower fire risks.

Top U.S. Regions Prone to Wildfires: A Look at the Areas with the Highest Occurrence

Home Size and Construction

The size of your home and the materials used in its construction can also affect your fire insurance premiums. Larger homes or homes built with materials that are more susceptible to fire damage, such as wood, may have higher premiums compared to smaller, fire-resistant homes.

Coverage Limits and Deductibles

The more coverage you have, the higher your premium will be. If you opt for a higher coverage limit to ensure that your home and belongings are fully protected, expect to pay a higher premium. Similarly, your deductible—the amount you pay out-of-pocket before your insurance kicks in—can also influence your premium. A higher deductible usually results in lower premiums, but it means you’ll need to pay more if you need to file a claim.

Home Safety Features

Homes with fire safety features such as sprinklers, fire-resistant roofing, or smoke detectors may be eligible for discounts on fire insurance. Insurance providers often reward homeowners who take steps to reduce the risk of fire damage.

Tips for Homeowners to Ensure Proper Fire Insurance Coverage

To make sure your fire insurance policy provides adequate protection, follow these practical tips:

Regularly Review Your Policy

It’s important to review your fire insurance policy regularly, especially if you've made significant changes to your home. For example, if you've renovated your kitchen, added a new room, or purchased expensive items, you'll want to update your policy to ensure that these additions are covered.

Understand Your Policy's Exclusions

Fire insurance policies typically have exclusions, such as damage caused by negligence or intentional acts. Make sure you understand what is and isn’t covered under your policy. Some policies may also exclude certain types of fires, such as those caused by earthquakes or flooding, so it's crucial to know the limitations of your coverage.

Shop Around for the Best Rates

Just like with any type of insurance, it’s important to compare quotes from different providers to ensure you're getting the best rate for the coverage you need. Online tools and insurance brokers can help you find the best deals and coverage options.

Bundle Insurance Policies

Many insurance companies offer discounts if you bundle fire insurance with other policies, such as homeowners or auto insurance. This can help you save money on your premiums while ensuring that you have comprehensive coverage for your property.

Maintain Fire Prevention Measures

Taking steps to reduce the risk of fire can not only help protect your home but also lower your insurance premiums. Regularly check for fire hazards such as faulty wiring, clogged chimneys, or dry landscaping near your home. Installing smoke detectors, fire extinguishers, and sprinkler systems can also reduce your fire risk and may qualify you for discounts on your policy.

Protect Your Home with the Right Fire Insurance Coverage

Understanding fire insurance coverage, costs, and tips is essential for homeowners who want to protect their property and belongings from the devastating effects of a fire. By ensuring that your home is properly covered, reviewing your policy regularly, and taking steps to reduce fire risks, you can have peace of mind knowing that you’re prepared for any emergency.

If you haven't already, consider reviewing your fire insurance policy today to make sure it meets your needs. If you found this article helpful, feel free to share it with friends and family, or leave a comment below with any questions you may have about fire insurance.