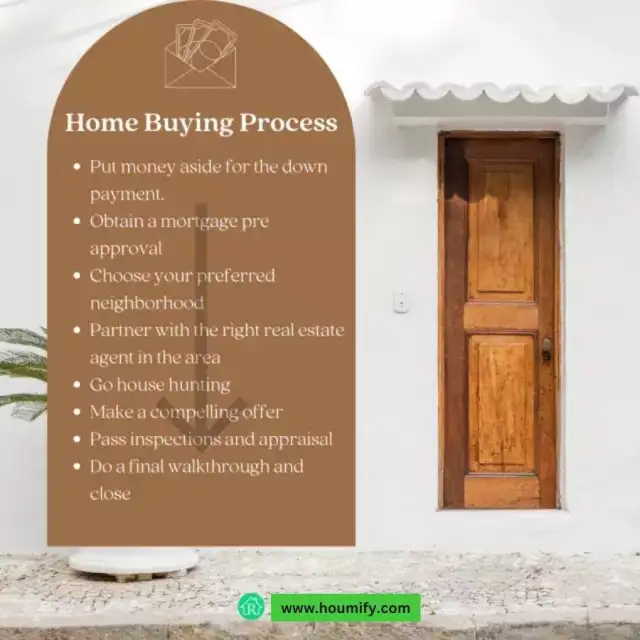

The Homebuying Journey An In-Depth Guide to Buying a Home

Embarking on the journey to buying a home is an exciting yet complex endeavor. Whether you're a first-time homebuyer or looking to upgrade your current living situation, understanding the detailed steps involved can make the process smoother and more enjoyable. This comprehensive guide breaks down the homebuying process into manageable steps, ensuring you are well-prepared to make informed decisions along the way.

Step 1: Assess Your Readiness

Before diving into the financial aspects, it’s crucial to determine if you’re emotionally and practically ready for homeownership. Consider your future plans, such as starting a family or potential job relocations. Assess your financial stability by evaluating your income, savings for a down payment, and credit score. Lenders typically require a minimum credit score of 620 for conventional loans and 580 for FHA loans. Calculate your debt-to-income ratio (DTI) to ensure it meets lender requirements, usually around 43% or less. Ensuring you are prepared can help avoid potential pitfalls down the road.